In today's unstable market landscape, building a resilient portfolio is paramount. Modern portfolio management tactics emphasize diversification, asset allocation, and risk management to navigate market challenges. A well-structured portfolio should feature a variety of assets across different fields, providing safety against unforeseen circumstances.

- Assess your risk limit.

- Allocate your investments across asset classes.

- Routinely analyze your portfolio performance and make alterations as needed.

By implementing these tips, you can cultivate a more resilient portfolio that is better positioned to weather market fluctuations.

Impact Investing: Aligning Portfolios with Environmental, Social, and Governance Goals

In today's dynamic global landscape, investors are increasingly seeking to align their portfolios with beliefs that extend beyond monetary returns. Sustainable investing, also known as conscious investing, is a rapidly growing movement that seeks to apply environmental, social, and governance (ESG) factors into investment decisions.

By backing companies with strong ESG ratings, investors can impact positive change in the world while also seeking to generate competitive returns. This approach recognizes that entities play a crucial role in addressing global challenges such as climate change, social inequality, and accountability issues.

Sustainable investing offers a range of systems to meet investor objectives, from actively preferring companies with exemplary ESG practices to eliminating companies involved in unethical activities. A well-diversified portfolio that incorporates ESG factors can help mitigate risks and strengthen overall portfolio resilience.

- Some investors choose to emphasize on specific ESG themes, such as renewable energy or sustainable agriculture.

- Others may prefer a more universal approach that considers the full spectrum of ESG factors.

- Regardless of their tactic, investors who embrace sustainable investing are committed to creating a more just and sustainable future.

Navigating Market Volatility: Effective Portfolio Diversification Techniques

Market volatility can be a daunting prospect for investors. shift market conditions often lead to uncertainty and risk. However, savvy investors understand the importance of utilizing effective portfolio diversification techniques to lessen potential losses and enhance long-term returns.

Diversification involves deploying investments across a variety of asset classes, sectors, and geographic regions. By forming a well-diversified portfolio, investors can even out the impact of detrimental market swings on their overall returns.

A popular approach to diversification is the typical 60/40 allocation, which consists 60% in stocks and 40% in bonds. However, there are diverse other diversification strategies that investors can research.

A number of popular portfolio diversification techniques include:

- Asset Allocation: This involves allocating investments among different asset classes, such as stocks, bonds, real estate, and commodities.

- Sector Diversification: Investing in companies from distinct sectors of the economy can diminish risk by counterbalancing the performance of any specific sector.

- Geographic Diversification: Expanding investments across different countries and regions can help in controlling risk associated with environmental factors in a definite country or region.

Improving Portfolio Outcomes

Achieving financial success requires a well-structured financial plan. read more Effective investment management involves strategically allocating assets across several asset classes to maximize returns while simultaneously controlling risk. A diversified asset arrangement helps spread exposure and potentially smooths market volatility. Financial advisors should regularly modify their portfolios to ensure they align with their investment objectives. By employing a disciplined system, investors can strengthen the probability of achieving their long-term financial ambitions.

Crafting Optimal Investment Portfolios

A well-crafted investment portfolio is like a finely tuned machine, designed to deliver consistent returns while mitigating risk. At the heart of this process lies asset allocation, the strategic distribution of investments across various asset classes such as shares, debt securities, and real property. By carefully allocating these assets, investors can tailor their portfolios to correspond to their individual risk tolerance, investment horizon, and financial goals.

Diversification is a key principle steering asset allocation. By spreading investments across different asset classes, investors can reduce the overall volatility of their portfolio and enhance its resilience to market fluctuations. Additionally, each asset class tends to perform differently under various economic conditions, providing a buffer against potential losses in any one sector.

- Assess your risk tolerance: Are you comfortable with considerable market volatility or do you prefer a more risk-averse approach?

- Determine your investment horizon: How long do you plan to invest your money? Longer time horizons allow for greater risk-taking.

- Outline your financial goals: Are you saving for retirement, a down payment on a house, or something else? Your goals will influence the appropriate asset allocation strategy.

Regularly modifying your portfolio is crucial to maintain its alignment with your investment objectives. Market conditions can change over time, impacting the performance of different asset classes. By periodically rebalancing, investors can ensure that their portfolios remain well-composed and continue to meet their goals.

Enhancing Portfolio Outcomes with Performance Analysis and Rebalancing

Regularly evaluating your portfolio's performance is crucial in achieving long-term investment goals. Via a comprehensive review, you can find areas which may require adjustment and fine-tune your portfolio's composition with your wealth objectives. Reorganizing your portfolio involves making strategic changes to asset structure, bringing it back into balance with your initial tactic.

- Core benefits of regular portfolio performance analysis and rebalancing include:

- Risk minimization

- Maximized gains

- Greater investment variety

A well-defined rebalancing calendar can help you stay on track and manage the impact of market volatility. Keep in mind that portfolio management is an ongoing process where requires continuous supervision.

Andrew Keegan Then & Now!

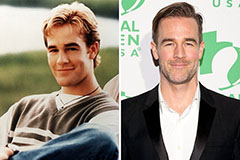

Andrew Keegan Then & Now! James Van Der Beek Then & Now!

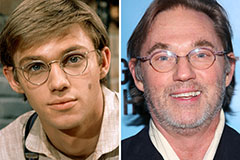

James Van Der Beek Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!